Please call your financial institution's customer service for help. Your financial institution then directs the payment into your bank account, all while keeping your sensitive account details private. Zelleis a fast, safe and easy way to send money to friends, family and others you trust, right from the West Community Credit Union mobile app. Zelle makes it easy to send money to, or receive money from, people you trust with a bank account in the U.S.Learn More. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle.

Must have a bank account in the U.S. to use Zelle. It's important to only send money to people you trust, and always ensure you've used the correct email address or U.S. mobile number when sending money. Businesses in the Accelerated Rewards Tier have access to additional experiential rewards and a fixed point value airline travel reward. You can send, request, or receive money with Zelle.

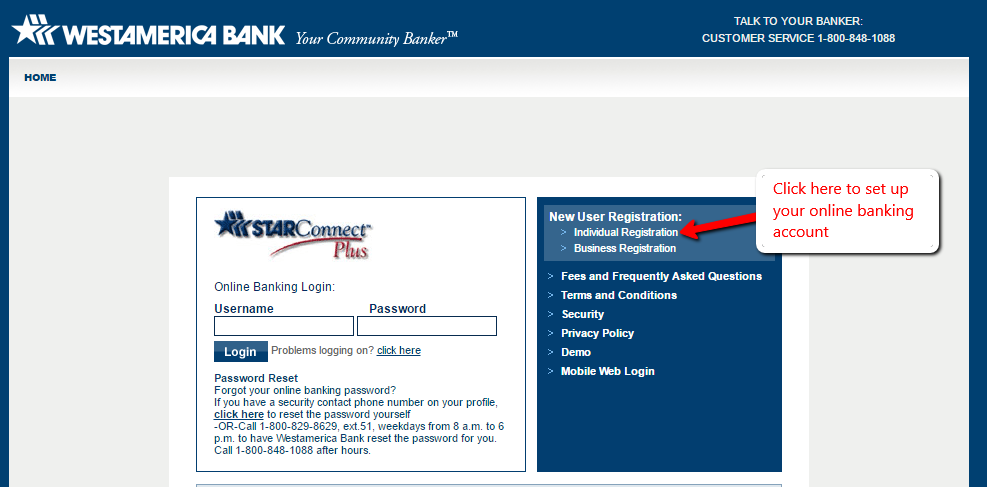

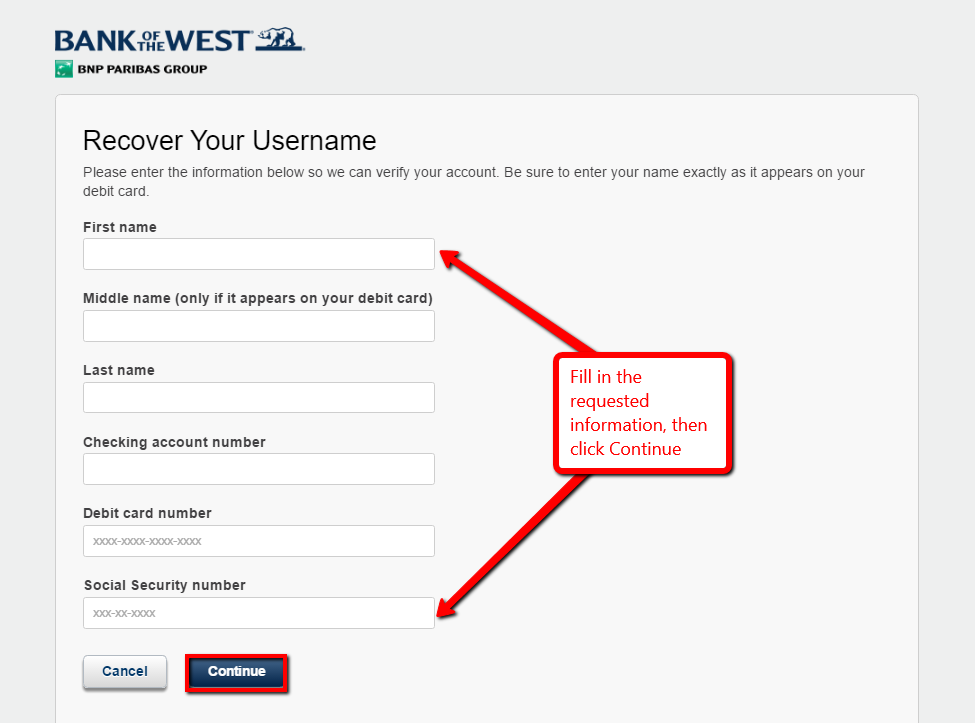

To get started, log into your online banking or mobile app and select "Send Money with Zelle®". Enter your email address or U.S. mobile phone number, receive a one-time verification code, enter it, accept terms and conditions, and you're ready to start sending and receiving with Zelle. If you're enrolling in mobile and online banking to access your business accounts, you'll need an ATM or debit card. You can apply for these at a branch and use your PIN to log in to mobile or online banking.

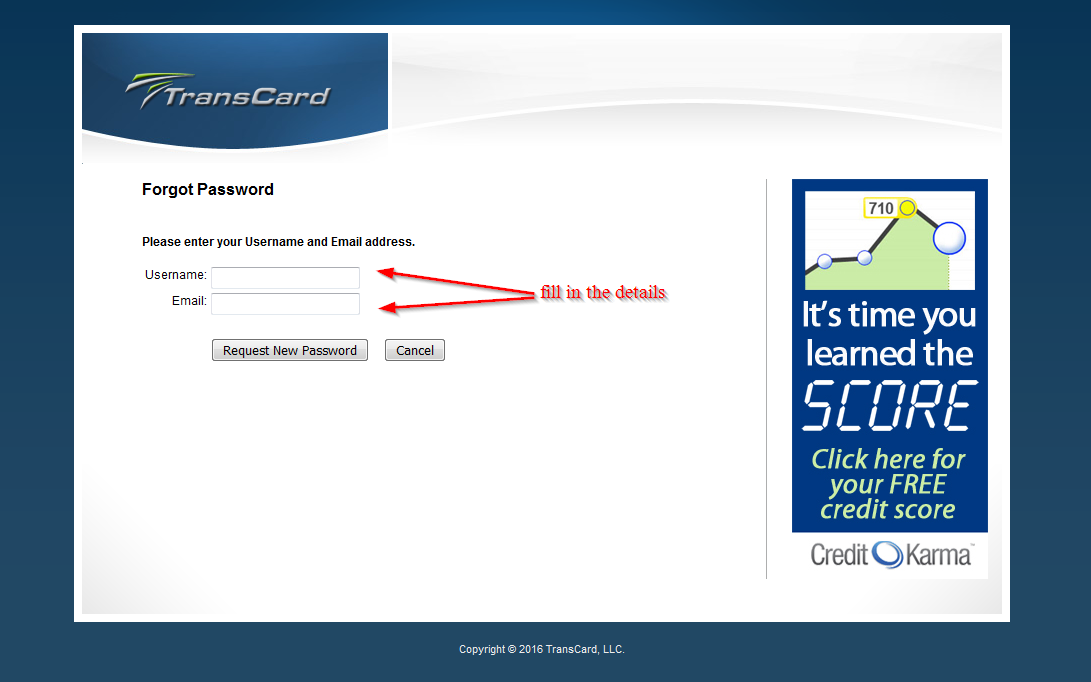

Next, create a unique username and password to log in securely in the future. Just follow the instructions on the enrollment page. If the person you sent money to has already enrolled with Zelle, the money is sent directly to their bank account and cannot be canceled. This is why it's important to only send money to people you trust, and always ensure you've used the correct email address or U.S. mobile number when sending money. The redemptions will post within 2 to 8 business days. Businesses may redeem reward dollars for cash back to a First Citizens checking or savings account or credit card statement credits and Pay Me Back statement credits.

Our online banking security uses advanced encryption and monitoring technology to ensure your money stays safe and secure. And to keep your personal information confidential, we have strict policies and procedures in place. Only you have access to your accounts with your username and password. We strongly suggest you do not share your username, password, PIN or account number with anyone. We'll never request this type of information via email. Some exclusions apply to certain categories of transactions.

No statement credit will be applied, in whole or in part, against any monthly minimum payment due. The redemptions will post within 2-8 business days. You may redeem rewards dollars for account credits to be deposited to your First Citizens checking or savings account or applied to your First Citizens credit card, consumer loan or mortgage.

First Citizens does not charge fees to download or access First Citizens Digital Banking, including the First Citizens mobile banking app or First Citizens Text Banking. Mobile carrier fees may apply for data and text message usage. Fees may apply for use of certain services in First Citizens Digital Banking.

Your email address or U.S. mobile phone number may already be enrolled with Zelle at another bank or credit union. Call our customer support team and ask them to move your email address or U.S. mobile phone number to your financial institution so you can use it for Zelle. Keeping your money and information safe is a top priority. When you use Zelle within our mobile app or online banking, your information is protected with the same technology we use to keep your bank account safe. Our Digital Security Guarantee is another way we protect you from fraud loss. Whether you're signing in on your computer, tablet or using face ID to login to the Bank With United mobile app on your smartphone, your privacy and security are covered.

With over 180 years of banking experience, United Bank is a financial partner you can trust. If you're waiting to receive money, you should check to see if you've received a payment notification via email or text message. If you haven't received a payment notification, we recommend following up with the sender to confirm they entered the correct email address or U.S. mobile phone number. Since money is sent directly from your bank account to another person's bank account within minutes1,Zelle should only be used to send money to friends, family and others you trust. Our mobile banking app lets you conveniently and securely access your accounts anytime, anywhere.

All you need is an eligible account and a smartphone with access to the Internet. Most account information is updated in real time as transactions are processed throughout the day. Mobile and online banking offers you the most current balance and transaction information available. A fast, safe and easy way to send money directly from your bank account to another's.

The SouthState Mobile App lets you securely pay bills, send money, and manage your accounts anytime, anywhere. Connect and manage your financial health on-the-go with mobile and online banking, bill payment, and so much more. With Cash Back Rewards, you will earn 1 reward dollar for each $100 net dollars you spend for net retail purchases . Earned reward dollars are calculated on actual dollars spent rounded up or down to the nearest point. Reward dollars will be deducted from the available rewards account balance for all returned purchases. After you have logged in, select Profile and Preferences from the left navigation menu and then select Login Preferences.

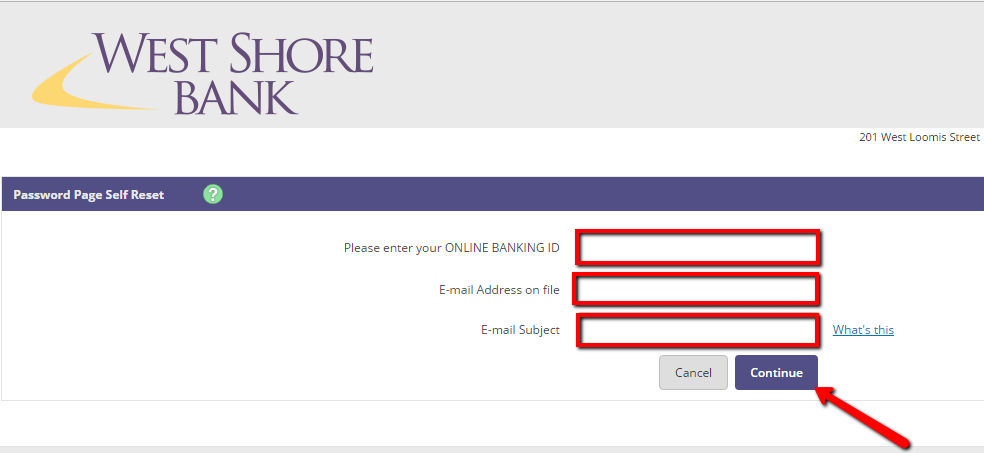

From this page you can reset your login ID, password and secure delivery method (the way you'll receive your one-time secure access code). If you are in the Digital Banking app, you can also manage fingerprint and 4-digit PIN access. If you can't log in, you'll have to call the Customer Care Center to have your secure login reset. If you pay bills, Bill Pay can save you time by eliminating bill preparation, check writing and even trips to the post office to mail your payments. You can pay bills quickly and easily using your PC or mobile device—without stamps or envelopes. Even better, funds for payments stay in your account until the payment clears the bank.

It's easy – Zelle is already available within your mobile banking app and online banking! Check our app or sign-in online and follow a few simple steps to enroll with Zelle today. By clicking 'Continue', you will leave our website and enter a site specific to making your loan payment via a debit card or electronic check. This icon indicates a link to third-party content. By clicking on the link, you will leave our website and enter a site not owned by the bank.

The site you will enter may be less secure and may have a privacy statement that differs from the bank. The products and services offered on this third-party website are not provided or guaranteed by the bank. Your questions are important to us and we're here to give you answers as quickly as possible.

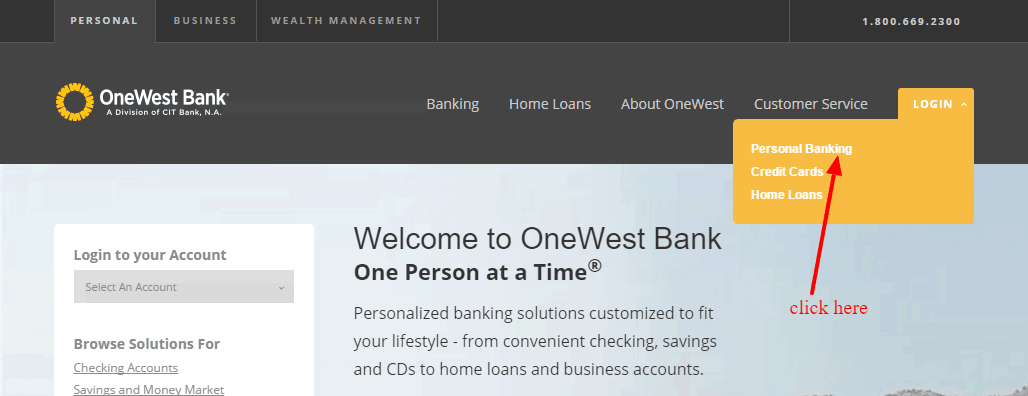

We promise to provide you a better banking experience with the best products and services, smart financial advice, and real people, you know and trust. Whether a credit card, personal savings account, or something else—discover exactly what you'll need to apply. Whether it's online banking or mobile banking, we offer all the tech the big banks do. To receive money, just share your enrolled email address or U.S. mobile phone number with a friend and ask them to send you money with Zelle. Access your account on your smartphone with the mobile banking app.

To set upaccount alerts, log in to usbank.com and selectMy Alertsunder Customer Service in the main menu. Open the Account Alerts tab and choose Add alerts at the right side of the page. Then you can select the account alerts that will best help you manage your accounts. With U.S. Bank mobile and online banking, convenient control of your money is always within reach. Learn about Northwest's innovative digital banking solutions. Whether you're enrolling in Bill Pay or My Credit Score or downloading our mobile app for the first time, we've created a library of interactive demos that will walk you through step-by-step.

Owning a business is challenging, but there are ways to make business banking easier, especially online. We have helpful cash management and remote deposit tools, as well as information on cybersecurity and commercial lending. It's a fast, safe and easy way to send money to people you know and trust. Building and sustaining a business isn't always easy. As your business banking partner, we help streamline the process with attentive service, competitive rates, and products designed to help your business succeed. Mobile Deposit from Glacier Bank gives you the power to deposit checks into your checking or savings account using your smartphone or other mobile device, wherever you are and whenever you want.

At the Accelerated Rewards Tier, you will earn 1.5 points for each $1 you spend for all net retail purchases . Earned points are calculated on actual dollars spent rounded up or down to the nearest point. Points will be deducted from the available rewards account balance for all returned purchases. There is no monthly point cap and points do not expire as long as you remain in the Accelerated Rewards Tier. From offering you a variety of deposit products to servicing your loans, we're dedicated to providing you with the resources to make your banking experience as convenient as possible. If you'd like to learn more about our dedication to serving your banking needs, please schedule an appointment at one of our banking centers.

If your payment is pending, we recommend confirming that the person you sent money to has enrolled with Zelle and that you entered the correct email address or U.S. mobile phone number. If you sent money to the wrong person, we recommend contacting the recipient and requesting the money back. If you aren't able to get your money back, please contact your financial institution's customer service. Our digital banking services offer you a simple, secure way to bank from anywhere, anytime.

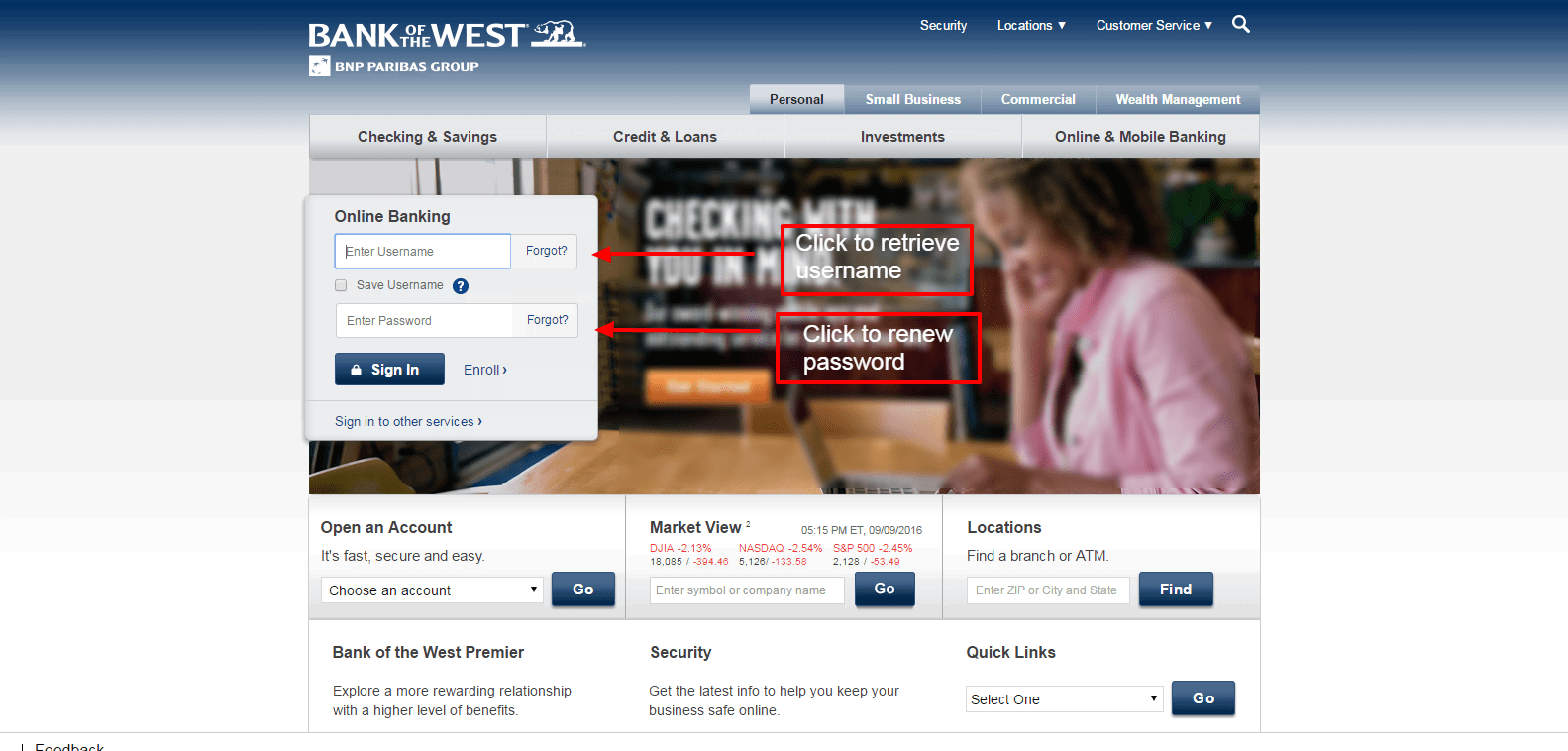

• Access up to 7 years' worth of checking, savings, CD and credit card account statements online. Be the master of your money with the Bank of the West app. Enjoy secure access to your accounts and manage your finances from virtually anywhere. To get the best online banking experience, please upgrade to a new browser. You may send us questions about product information and other issues via contact form, but be aware electronic messages sent are not protected by a high level of encryption. You should not use our contact form to initiate any banking transactions.

We will never request your password, PIN, account number or other confidential data via email. In a world of online banking, fraud and scams can happen at any time. Learn how to protect yourself from fraudulent scammers using our helpful information. At the Base Rewards Tier, you will earn 1 point for each $1 you spend for all net retail purchases .

When logging in to Digital Banking for the first time, visit our homepage and select First Time Log In from the login box. Enter the login ID you selected when you opened your account, and follow the steps to receive and enter your one-time Secure Access Code. You can easily enroll in Digital Banking on our homepage by selecting the Enroll Now link located in the login box. You'll need an active First Citizens account to get started.

If you don't have an account, you can open one online, visit your local branch or give us a call. West Valley National Bank was formed by a group of local residents from the West Valley area of Phoenix, Arizona. They strategically discussed the lack of quality financial services available to the small businesses in the West Valley. Android, Google Play, and the Google Play logo are trademarks of Google Inc.

Check with your mobile phone carrier for details. Apple and the Apple logo are trademarks of Apple Inc, registered in the U.S. and other countries. These transactions are potentially high risk (just like sending cash to a person you don't know is high risk).

Please contact your financial institution's customer service. You can only cancel a payment if the person you sent money to hasn't yet enrolled with Zelle. Follow the instructions provided on the page to enroll and receive your payment. Get text message alerts to help monitor your account.

You can choose when you want to be notified of any changes to the account balances or personal information. I have a personal relationship with Ms. Johnson. She knows me because I've been banking there a long time and I trust her. Securely activate and manage your cards with simple, do-it-yourself controls.

It's fast, easy and secure – online or in the app. This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control the products, services or content found there. Conveniently make your loan payment with a debit card or electronic check! Easily access all of your United Bank personal accounts 24 hours a day.

Check balances, transfer funds, review transaction history, place stop payments, order checks, and much more—anytime and from anywhere. For your convenience, Vantage West Credit Union provides links on our website to third party sites. Vantage West Credit Union does not provide, and is not responsible for the product, service, or overall website content available at a third party site. Vantage West Credit Union is not liable for any failure of products, services, or information advertised on the third party website. Please be advised that you will no longer be subject to, or under the protection of the privacy and security policies of our website.

With Pennies Count, every time you use your debit card, the system will round up to the nearest dollar and transfer the total sum to an account of your choosing. Earn points by making everyday purchases and pay no annual rewards program fee. Sign up for the VIP experience—an interest-bearing personal checking account with the best features. Get the upgrade with the personal checking account that pays you interest.

On that page, select the Create Account button located below the Log In button. Even if you have a First Citizens digital banking account, you'll need to create an account for our application system. Each reward dollar is worth $1, which means that $100 reward dollars equals $100 in redemption value. Redemptions start as low as $25 rewards dollars.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.